In the past decade, supply chains have had to adapt to an increasingly unpredictable world. Pandemic disruptions, strained geopolitical relations, and soaring shipping costs have pushed companies to rethink how and where they manufacture goods. One result? Nearshoring in Latin America is becoming a defining feature of global logistics.

Let’s break down what’s happening, why it matters for freight forwarders, and how joining a global logistics network can open new doors for those based in the region.

Why companies are betting on Latin America

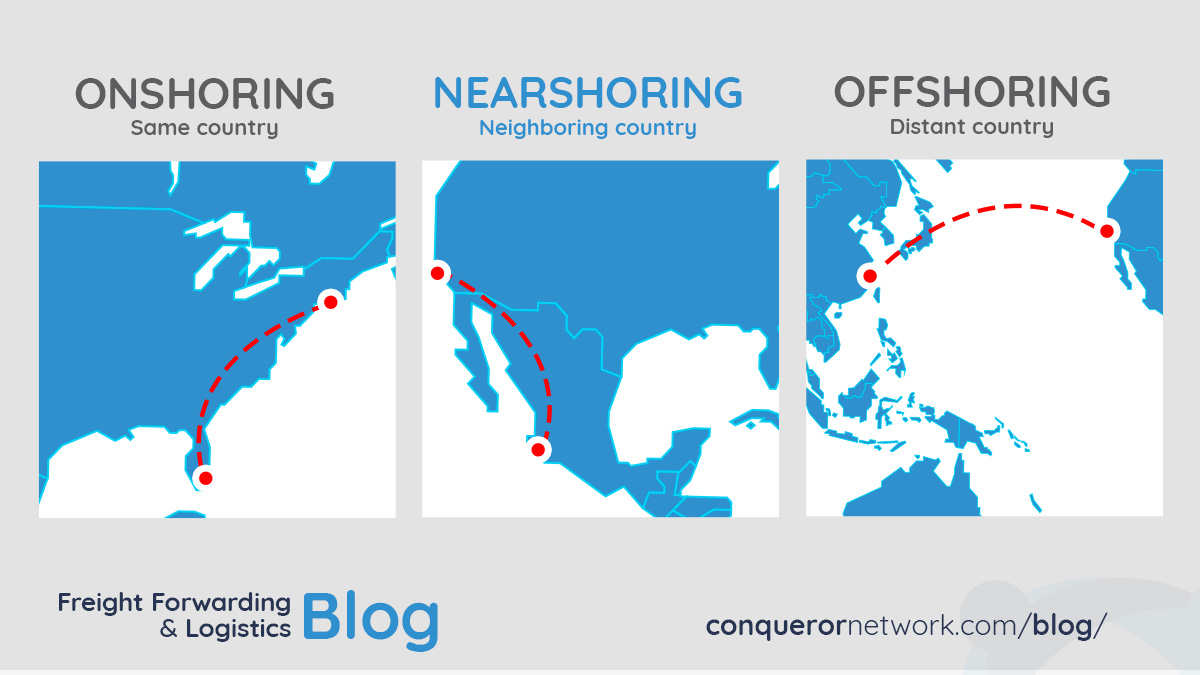

China’s decades-long reign as the world’s factory is being challenged—not because it’s lost its edge, but because the global supply chain model built around it has. Long lead times, port congestion, and trade tensions have made U.S. and European companies wary of overdependence on Asia.

Enter nearshoring in Latin America. Countries like Mexico, Colombia, Brazil, and Costa Rica offer a compelling combination: lower labor costs, proximity to the U.S. and Canada, strong trade agreements, and improving infrastructure. For many manufacturers, shifting production here simply makes more sense. Nearshoring is reshaping trade lanes and driving more intra-Americas cargo flows. And with that come big opportunities for local logistics providers.

Freight forwarders in Latin America: New challenges, new potential

Nearshoring in Latin America is increasing demand for cross-border logistics, warehousing, customs brokerage, and multimodal transport. Freight forwarders in the region are now tasked with moving high volumes of time-sensitive cargo such as automotive parts, electronics, and medical devices, both northward to the U.S. and internally across Latin American markets. This shift brings new pressures. Clients expect faster transit times, greater transparency, and competitive pricing. Forwarders need reliable partners, robust systems, and efficient last-mile delivery networks to meet these expectations. Freight forwarders in Latin America who can pivot quickly and build trusted cross-border relationships will have a serious edge.

Mexico leads, but it’s not alone

Mexico is the poster child of the nearshoring movement and for good reason. Its geographic proximity to the U.S., strong manufacturing base, and integration through USMCA (formerly NAFTA) make it a magnet for foreign investment. In fact, in 2023, Mexico surpassed China as the United States’ top trading partner.

But the nearshoring boom is spreading. Guatemala and Honduras are attracting textile and apparel investments. Brazil and Colombia are growing in automotive and electronics. Panama is becoming a regional distribution hub thanks to its strategic location and modern port infrastructure. Each country presents its mix of opportunities and challenges. What unites them is the need for capable, well-connected freight forwarders in Latin America to manage the flow of goods with precision.

Building regional strength with global reach

One of the keys to success for freight forwarders in Latin America is access to information, to partners, and global networks. This is where international freight forwarding alliances like Conqueror Freight Network come in. By joining a global logistics network, forwarders based in Latin America can connect with trusted agents in over 250 cities across 134 countries. That means when a client needs to move goods from a plant in Guadalajara to a retailer in Toronto or a warehouse in Rotterdam, members have immediate access to vetted partners who understand the local requirements. It’s not just about getting shipments from point A to B. It’s about offering clients a seamless logistics experience across borders with competitive pricing, fewer handoffs, and fewer delays.

Nearshoring in Latin America is also driving infrastructure growth

Governments across the region are waking up to the economic potential of nearshoring in Latin America. Mexico is investing heavily in industrial parks near its northern border. Colombia is working to modernize its highway network and boost port capacity. Brazil is expanding its rail corridors. These projects will take time, but they signal a long-term commitment to strengthening the logistics backbone of the region. For freight forwarders, this means planning ahead and aligning services with the shifting geography of manufacturing hubs and export routes. Staying ahead of these infrastructure changes can help forwarders optimize costs and offer smarter transit options to clients.

The sustainability factor

There’s another reason nearshoring is gaining traction: the environment. Shipping goods across the Pacific is carbon-intensive and, increasingly, bad PR. Companies with ambitious ESG goals are discovering that shorter supply chains can help reduce emissions and enhance transparency.

Nearshoring in Latin America offers an eco-friendlier alternative, especially when coupled with intermodal solutions like rail and inland waterways. Freight forwarders who understand how to integrate sustainability into their operations will be more appealing to global clients looking to green their logistics. This is a chance for forwarders in the region to not only grow their business, but also lead the way in shaping more responsible trade.

What comes next?

Nearshoring is still in its early innings. While the potential is massive, so is the competition. Asia isn’t going anywhere. And other regions like Eastern Europe and North Africa are also in the running for manufacturing relocations. But Latin America has the advantage of proximity, time zone alignment, and cultural ties with North America. The logistics industry is set to benefit as long as it can deliver on the promises of speed, reliability, and cost efficiency. Freight forwarders in Latin America who invest in partnerships, technology, and local expertise will be best positioned to ride this wave.