The year 2025 is already shaping up to be a transformative one, especially when it comes to freight routes. For freight forwarders, this presents not just a challenge—but an opportunity to redefine supply chain strategies and uncover new markets. The freight lanes of tomorrow are being drawn today, and the forwarders who adapt quickly will gain a decisive edge.

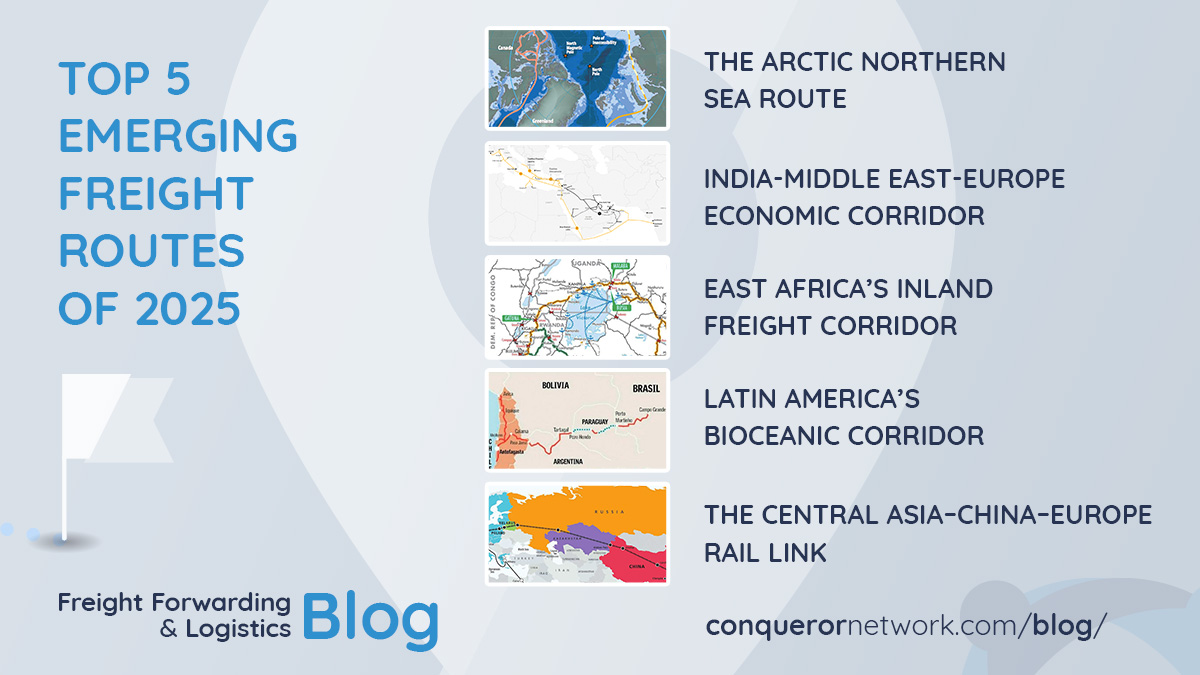

Let’s explore the top 5 emerging freight routes of 2025 and what they mean for freight forwarders around the world.

1. The Arctic Northern Sea Route (NSR)

As climate change reduces Arctic ice coverage during warmer months, a new shipping lane has started to emerge between Europe and Asia: the Northern Sea Route. By sailing north of Russia instead of through the Suez Canal, ocean carriers can cut nearly 40% off the traditional route length between Northern Europe and Northeast Asia.

For freight forwarders, the NSR introduces the potential for faster delivery times and reduced fuel consumption. However, this route is still seasonal and heavily dependent on weather conditions, icebreaker support, and complex geopolitical agreements—particularly between Russia, China, and Arctic Council nations.

While not yet a go-to option for year-round shipping, forwarders working with clients needing expedited delivery of high-value or time-sensitive goods might soon consider Arctic charters during summer months. It’s an opportunity that’s currently niche but growing quickly as infrastructure along Russia’s northern coast expands.

2. India-Middle East-Europe Economic Corridor (IMEC)

Announced during the G20 Summit, the India-Middle East-Europe Economic Corridor (IMEC) is being hailed as a counterweight to China’s Belt and Road Initiative. This ambitious multimodal route would connect India to Europe via the UAE, Saudi Arabia, Jordan, and Israel, using a combination of rail lines and maritime infrastructure.

For freight forwarders, the IMEC represents a seismic shift in trade connectivity. It shortens lead times and offers a stable alternative to traditional Red Sea routes, especially amid concerns about security threats and political instability in the Suez Canal zone.

With significant backing from the US and EU, the IMEC could drastically alter trade flows between South Asia and Europe. Freight forwarders with strong regional partnerships in the Middle East and South Asia will be particularly well-positioned to benefit. Establishing reliable contacts in emerging IMEC hubs—such as Mumbai, Dubai, and Haifa—will be crucial.

3. East Africa’s Inland Freight Corridor

East Africa has long suffered from inefficient freight movement, but the ongoing development of the Northern Corridor is changing that. Running from the Port of Mombasa in Kenya through Uganda, Rwanda, South Sudan, and the DRC, this overland corridor is rapidly improving thanks to infrastructure investment from regional governments and international donors.

For freight forwarders operating in Africa, this route opens up a cost-effective and reliable way to reach landlocked countries that previously relied on informal logistics chains or expensive air freight. With upgraded railways, highways, and customs facilities, the Northern Corridor is becoming a freight lifeline for East and Central Africa.

Forwarders should be aware that while opportunities abound, challenges remain. Delays due to customs bureaucracy, fluctuating road conditions, and regional security still exist. However, being a first mover in this space could establish long-term dominance in a fast-growing market.

4. Latin America’s Bioceanic Corridor

Connecting Brazil’s Atlantic coast to Chile’s Pacific ports via Paraguay and northern Argentina, the Bioceanic Corridor is being dubbed South America’s “new transcontinental backbone.” This road-and-rail route offers a strategic shortcut for Asian trade partners looking to access the Atlantic or for Mercosur exports heading to Asia.

For freight forwarders in South America, this emerging corridor is a game changer. It provides an alternative to the congested Panama Canal and reduces dependence on long maritime routes. Countries like Paraguay—traditionally excluded from maritime trade—are now gaining significant leverage in regional logistics.

Forwarders should start evaluating warehousing and consolidation opportunities in key cities like Campo Grande (Brazil), Salta (Argentina), and Antofagasta (Chile). The corridor’s full potential will materialize as regional governments complete the missing infrastructure links by 2025.

5. The Central Asia–China–Europe Rail Link

Rail freight between China and Europe has been on a steady rise, but 2025 marks a new chapter with the increasing importance of Central Asian countries. Kazakhstan, Uzbekistan, and Turkmenistan are emerging as critical connectors in a multi-rail system that links China’s western provinces with Europe via Russia, the Caspian Sea, and even the South Caucasus.

For freight forwarders, this means a robust alternative to both maritime and air freight, particularly for mid-value cargoes that require balance between cost and speed. The Middle Corridor—which bypasses Russian territory—has gained traction due to the geopolitical tensions stemming from the Russia-Ukraine war.

Rail forwarding along this route requires collaboration with multiple operators, customs brokers, and last-mile partners. Still, those who build strong alliances with Central Asian logistics firms will be better positioned to offer clients a secure, efficient, and increasingly competitive route.

What these emerging routes mean for freight forwarders

Each of these emerging freight corridors shares a few things in common: geopolitical complexity, heavy infrastructure investment, and the potential to transform regional economies. For freight forwarders, the implications are profound.

First, these routes require strong local partnerships. Many of these regions operate under vastly different regulatory, linguistic, and logistical systems. Establishing trusted agents on the ground is not a luxury—it’s a necessity.

Second, freight forwarders must invest in multimodal capabilities. These routes rarely rely on a single mode of transport. Being able to seamlessly transition between sea, rail, and road will set forwarders apart in these complex corridors.

Third, these emerging lanes call for digital readiness. Real-time cargo visibility, automated customs processes, and digital booking systems will become standard expectations, especially in regions where infrastructure is catching up to demand.

Lastly, there’s a branding opportunity. Forwarders who establish themselves early in these developing routes can position their businesses as pioneers. That means more exposure, stronger client trust, and—ultimately—higher margins.

Conclusion

The freight world is on the move—literally. New corridors are emerging, old routes are being disrupted, and freight forwarders must stay agile if they hope to thrive. Whether it’s navigating the Arctic seas, leveraging the rise of Central Asian rail, or pioneering logistics through Latin America’s heartland, those who adapt first will lead the charge.

Now is the time for freight forwarders to review their trade lane strategies, invest in regional knowledge, and begin exploring partnerships across these new corridors. The routes of 2025 won’t just change where cargo moves—they’ll change who moves it best.